Offices for rent near Torino: choose the one that suits you!

Are you looking for a new space to take your business to the next level? The offices for rent in the Europalace Offices Multifunctional Centre in Turin are exactly what you need to grow your business.

You will be able to collaborate with the most competent professionals in the area, and you will also have at your disposal an exclusive location in terms of design, comfort, visibility and strategic position, to present your products/services or welcome clients and suppliers.

The offices of the Europalace are located a few kilometers from the city, on the Turin-Pinerolo provincial road, opposite the FIAT Research Centre, close to the ring road tollgate and the Intermodal Centre Site, our offices for rent in the province of Turin are the key to the success of your business.

Why rent an office at the Europalace Business Centre?

Come and discover the exclusive advantages of Europalace Offices! No more worries about organizing your business: with our contractual formulas you will have everything you need to manage your work easily and efficiently.

Thanks to its strategic location in Orbassano, you will be in the heart of the junction of the major arterial roads but at the same time just a few kilometers from the historical center of Turin. With Europalace Uffici you will finally be able to concentrate on your work and receive your clients with the utmost professionalism, without stress.

Interior customisation

Turnkey real estate renovation of offices with our selected partners

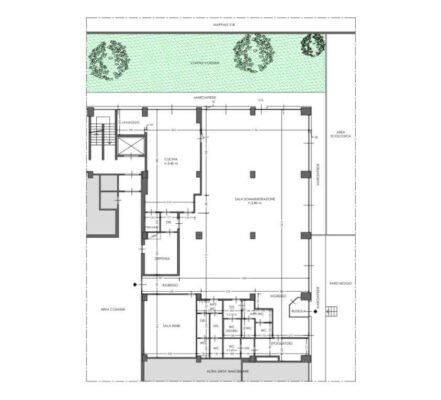

Availability of garages and parking spaces

Prestigious locations

No brokerage costs

Contacts with the network of companies in the structure

Strategic positioning

Bar and restaurant with self-service

Gym

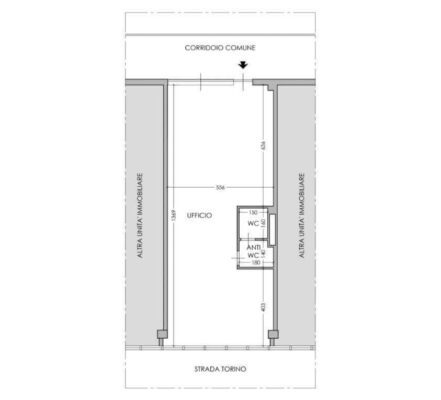

Discover the available offices for rent and their characteristics

Our commercially leased offices can be divided into three macro categories according to their size, to accommodate projects of different size and scope:

Do you have a business and are you looking for premises near Turin? Europalace Uffici is your ally! With over 30 years of experience, we are experts in identifying the most suitable solution for your needs, whether you are an entrepreneur, start-up or established company.

Don’t look elsewhere: grow your business with Europalace Uffici!

Stai pensando di affittare un ufficio?

Inizia a progettare il tuo futuro, crea il tuo ufficio.

Progettiamo insieme il tuo nuovo spazio di lavoro

Il servizio di configurazione è adatto alle aziende che, oltre alla necessità di comprare o affittare un ufficio, vogliono personalizzare il proprio luogo di lavoro.

Inizia a progettare per il futuro

Passa dalla progettazione alla visualizzazione del tuo nuovo ufficio con il rendering 3D, e trasforma il tuo progetto in una realtà concreta. Scegli la personalizzazione su misura e realizza il tuo spazio di lavoro ideale.

Personalizzazione del tuo ufficio

Grazie all’aiuto dei nostri architetti e designer potrai personalizzare l’ufficio scegliendo: il layout delle aree di lavoro, i materiali, il design dell’arredamento e delle luci.

Thinking of renting an office?

Start planning your future, create your office.

Let us design your ideal workspace together

We offer a tailor-made configuration service, suitable for companies wishing not only to buy or rent an office, but also to customize their workspace to reflect the image and values of their business.

Start designing for the future

Switch from simple design to 3D Rendering: see your office come to life before your eyes, with a clearer, more precise and detailed view of the entire workspace.

Customize your office

Do you want to transform your office into a unique environment perfectly suited to your needs? With the help of our architects and designers, you will have the opportunity to customize every aspect: from the layout of workspaces to the choice of materials and the design of furniture and lighting.

Other services we offer

Do you want to rent an office? Here's what to know!

What is the rental contract for non-residential use?

With the lease contract for non-residential use, a person (called lessor) grants another person (commonly called “tenant”) the enjoyment of a property intended for non- residential use upon payment, by the tenant , of an amount freely determined by the parties.

Non-residential use includes, by exclusion, all lease contracts that do not have as their object a property used by the tenant as his own home.

More precisely, therefore, these are properties intended for carrying out commercial activities.

What is the minimum duration of the lease?

If the property is used for commercial activities, generally the minimum duration of the lease is not less than six years, tacitly renewable by 6 years. A different duration can be established during the contractual definition phase.

Can the tenant withdraw from the contract?

Generally the parties establish in the contract that the tenant can withdraw from the contract at any time, except for various clauses that could oblige the payment of a minimum of fees, giving notice to the lessor by registered letter at least six months before the withdrawal date.

Is the lease renewed automatically?

In the case of rental contracts issued for commercial activities, the law provides that the contract is automatically renewed at each expiry.

Is there an ISTAT update to the rent of a commercial property?

Commercial leases can provide for the ISTAT adjustment of the rent. This hypothesis must be expressly provided in the contract.

Nella locazione di un immobile commerciale c’è la cedolare secca?

Diversamente dal contratto per usi abitativi, al contratto di locazione ad uso non abitativo non si applica l’opzione della cedolare secca.

Is there a dry coupon when renting a commercial property?

Unlike the contract for residential use, the option of dry coupon does not apply to the lease contract for non-residential use.

Who is covered by the registration fees for the lease?

The lease contract must be registered and the relative costs are shared between the parties at 50%, with stamp duty to be paid by tenant and registration tax to be paid by the lessor.

How does the distribution of condominium expenses work?

The condominium expenses of the lease are divided into ordinary and extraordinary. The ordinary expenses are paid by the tenant while the extraordinary expenses are paid by the lessor.

How much is the security deposit?

The tenant pays the lessor usually no more than three months’ rent as a deposit. This sum is productive of interest which must be paid to the tenant by the lessor at the end of each year.

Can the tenant sublease the property to third parties?

Only if his company is rented or transferred together with the property, the tenant can sublease the property to third parties or transfer his lease contract even without the owner’s consent. In this case, it will be sufficient to notify the lessor by registered letter with acknowledgment of receipt.